As medical practices face ongoing challenges like rising costs and reduced reimbursements, many Physicians have sought out wealth building outside the practice through real estate investments.

When approaching a closing on commercial real estate it’s optimal to consider all strategies and objectives. If minimizing tax is a key concern, then a 1031 tax deferred exchange may the ideal path to evaluate.

What if you could invest alongside an expert? We create unique opportunities for physicians to co-invest leveraging their lease on clinical space.

Navigating a medical office lease involves addressing these key legal concerns to ensure the agreement supports your practice’s needs and compliance requirements.

A properly negotiated transaction could significantly benefit a practice by tens to hundreds of thousands of dollars over the course of a lease term. Here are key potential pitfalls to avoid to ensure maximum profitability.

As a business owner at some point you made the strategic decision to own your space. It is definitely a great plan to gain control, secure an asset and perhaps lay the groundwork to enhance your retirement plan. When does it make sense to sell it?

As an owner in a successful privately held medical practice, you are likely aware of colleagues in other practices that have acquired real estate or participated in a Joint Venture to develop a medical building or maybe have even sold a building. Should you consider doing the same?

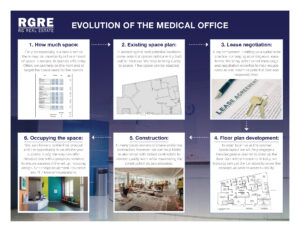

Learn about the six practical steps to setting up your medical practice space.

Maybe you’ve faced that decision in your practice: Deliberating over the latest rental rate increase and the concern for adding an asset to your portfolio.

“CARE” is the medical client-centric approach that ensures positive practice outcomes.