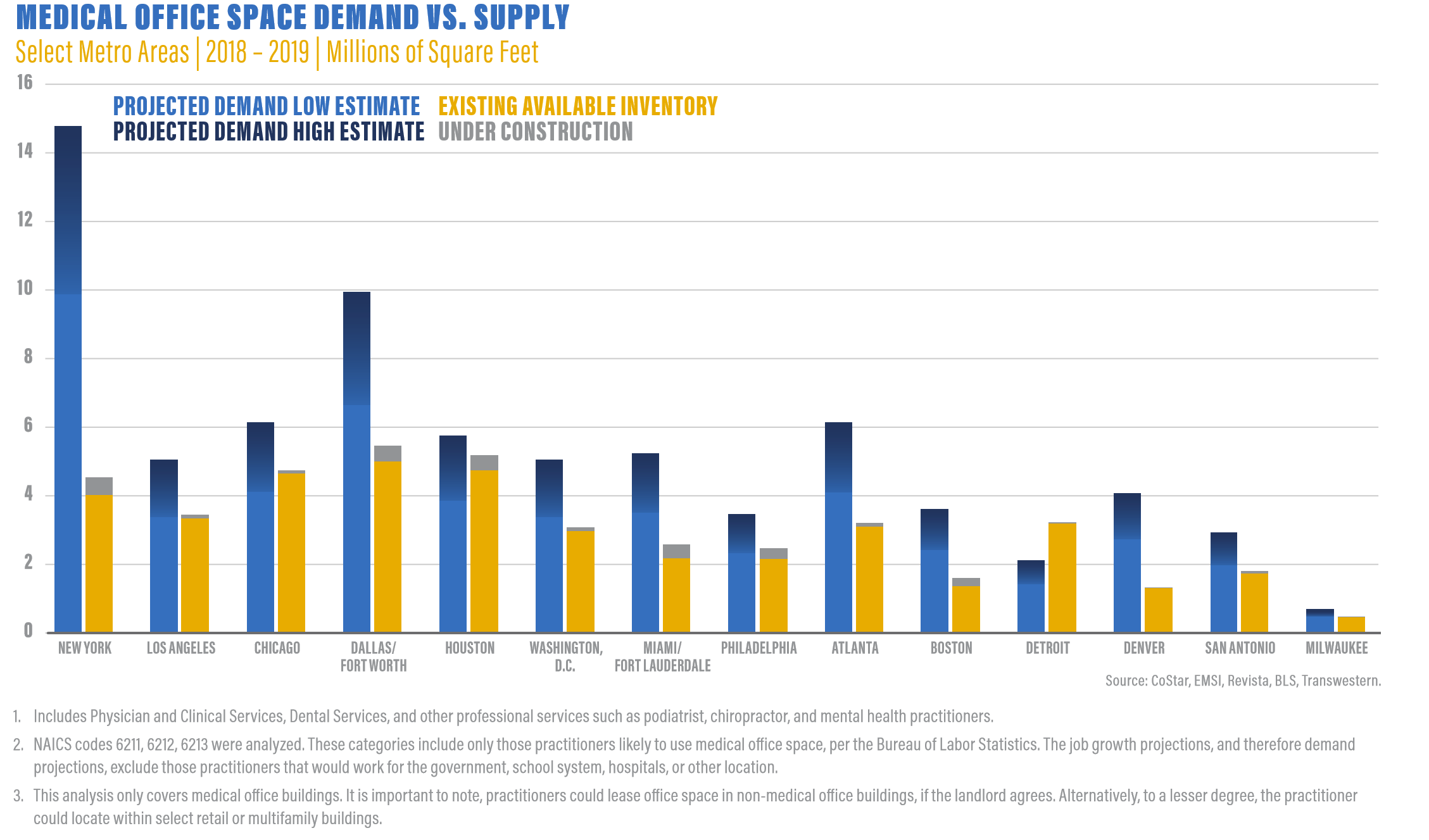

Medical building sales in the U.S. hit nearly $10 billion in 2019

Investment in healthcare real estate has risen dramatically in the last five years, with the investors betting that medical facilities will be increasingly important to an aging population.

The sales figure has doubled from 2014, according to JLL research. Many industrial investors are realizing that healthcare property returns have been pretty solid and steady over time. Healthcare spending by aging baby boomers has propelled medical properties into the mainstream.

Aging baby boomers have altered that point of view and propelled medical properties into the mainstream. By 2030, all baby boomers in the U.S. will be older than age 65, according to the U.S. Census Bureau. Five years later, the number of people 65-years-old and up will outnumber those under 18 years old. By 2060, one in four people — or 95 million — will be 65 or older, and 20 percent of those will be over 85.

Technological advances could keep many baby boomers living independently longer and in turn, that could extend care needs at outpatient facilities – and therefore more demand.

As long as trends in healthcare continue to point toward longer lifespans and increased care, medical office space will remain critical and demand will increase

Michael is a leader in Atlanta real estate with experiance supporting healthcare providers and investors. His experience will help guide you trough the right strategy.